Adjusted cash book format pdf A bank reconciliation statement is a document that compares the cash balance on the companys balance sheet to one of the three basic financial statements. A In the Cash Book as it was dishonoured after 31st Dec. adjusted cash book format.

Adjusted Cash Book Format, For instance if an employee had stolen some of the companys cash receipts before the money was recorded in the companys accounts and obviously not deposited in the companys bank account the missing amount will not be detected by the bank. In most businesses two or three column cash books with a bank column are used to record any transactions made through the bank account. Debit memos Adjusted book.

Worked Example On Bank Reconciliation Statement Dutable From dutable.com

Worked Example On Bank Reconciliation Statement Dutable From dutable.com

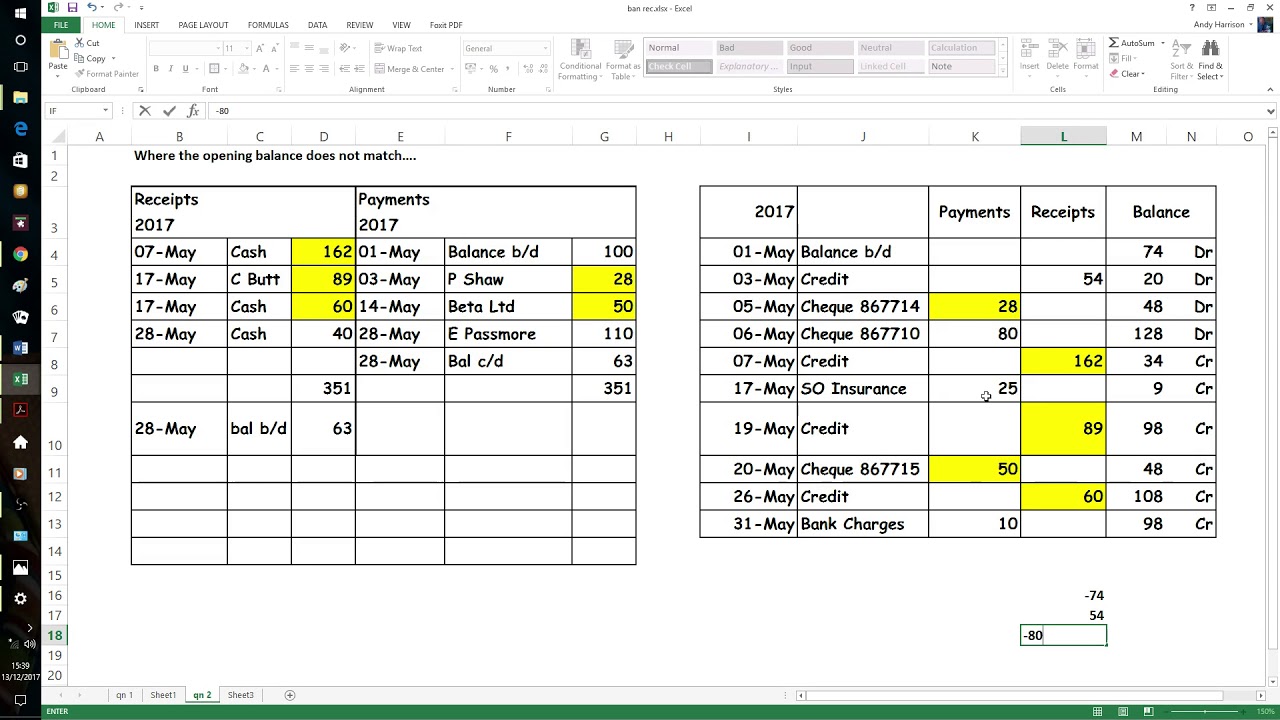

Bank Lodgement not shown on Bank Statement Cheques deposited on 311. Recorded in cash book on. Cash Book Template With Discount.

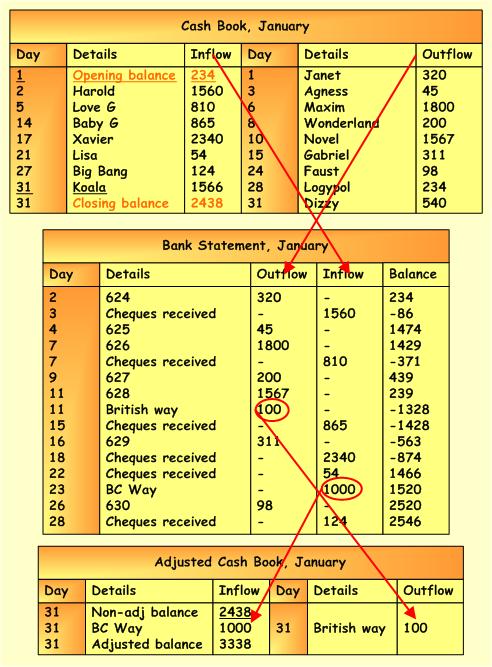

Close the Cash Book to find out the balance Prepare Bank Reconciliation Statement by taking the Cash Book balance and remaining transactions which are not adjusted against amended Cash Book.

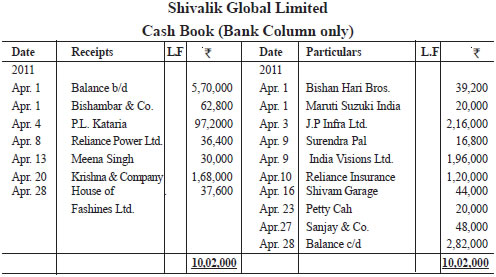

Bank Charges 50 Handling fee for dishonoured cheque. The cash book shows a balance of Rs 33000 whereas the pass book shows a balance of Rs 39930. Two column cash book. Adjusted cash book balance Sample bank reconciliation form. All the transaction which is recorded in the cash book has the two sides ie debit and credit. TYPES OF CASH BOOK Cash book can be of four types.

Another Article :

This is just similar with the book to bank method but in this method instead of the book being reconciled with the bank balance the bank balance is being reconciled with the book or the bank balance is adjusted to equal the amount of the cash in the book balance. For instance if an employee had stolen some of the companys cash receipts before the money was recorded in the companys accounts and obviously not deposited in the companys bank account the missing amount will not be detected by the bank. Two column cash book. Triple Column Cash Book. Bank Lodgement not shown on Bank Statement Cheques deposited on 311. Bank Reconciliation Statement Video Guide Hs Tutorial.

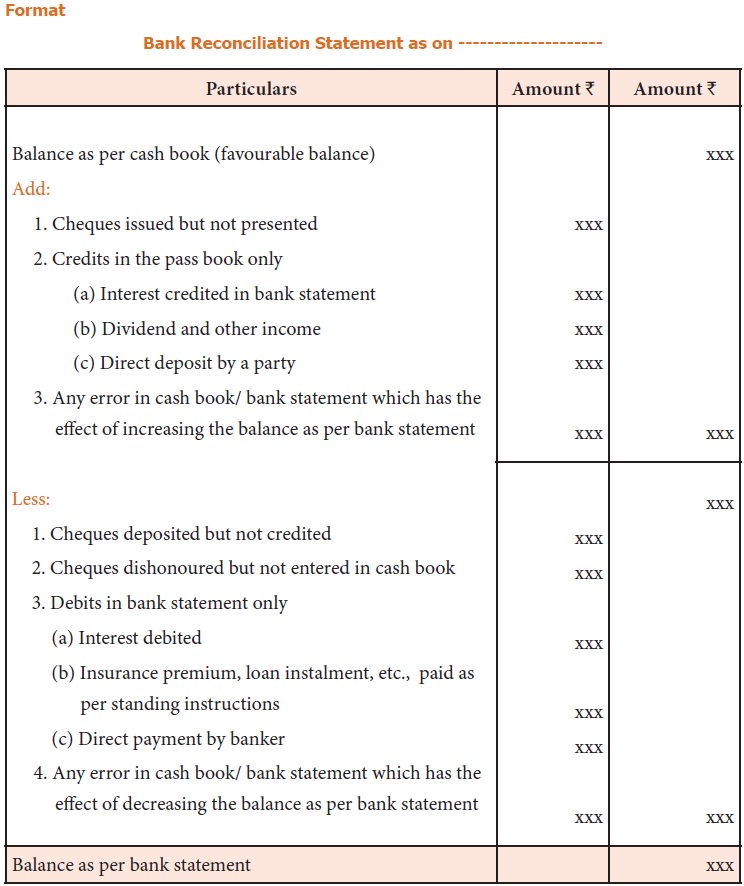

Debit memos Adjusted book. Debit memos Adjusted book. If one looks at the debit side of the cash book and the deposits column of the pass book and checks item by item one will find that the following cheques deposited with the bank. Close the Cash Book to find out the balance Prepare Bank Reconciliation Statement by taking the Cash Book balance and remaining transactions which are not adjusted against amended Cash Book. Format of Bank Reconciliation Statement BRS Lets understand these formats with an example. Simple Cash Book Format Design For Quick Money Tracking.

Date Particulars and Amount. This format of Cash Book is useful when either there is no bank transaction or bank transactions do not occur frequently. Solved Example for You. It is very identical to a traditional cash account in which all cash receipts are recorded on left hand debit side and all cash payments are recorded on right hand credit side in a chronological order. Triple Column Cash Book. Preparing A Bank Reconciliation Statement Method Format Steps And Rules Solved Example.

In this Cash Book three amount columns are maintained on both the debit and credit sidesthe first column is for discount the second for cash and the third for bank. In most businesses two or three column cash books with a bank column are used to record any transactions made through the bank account. Recorded in cash book on. The cash book shows a balance of Rs 33000 whereas the pass book shows a balance of Rs 39930. Receipts in bank statement not in the cash book. Format Of Bank Reconciliation Statement Qs Study.

In this Cash Book three amount columns are maintained on both the debit and credit sidesthe first column is for discount the second for cash and the third for bank. Having the Adjusted balance per BANK Adjusted balance per BOOKS does not guarantee that the companys cash has been completely accounted for. Format for bank reconciliation statement Before I share the format of a bank reconciliation statement please note that if on preparing your adjusted cash book the balance on the adjusted cash book agrees with the balance as per the bank statement then there is no need to. The receipts are recorded in the Dr Side and the payments are recorded in the Cr side of the cash book. Bank Charges 50 Handling fee for dishonoured cheque. Revised Adjusted Cash Book With Bank Reconciliation Statement In Hindi By Jolly Coaching Youtube.

Cash Book and Bank Statement. Interest received on bank statement 45 070613. This format of Cash Book is useful when either there is no bank transaction or bank transactions do not occur frequently. For your financial statements to be accurate you must prepare and post adjusting entries. Single Column Cash Book. Preparing A Bank Reconciliation Statement Method Format Steps And Rules Solved Example.

If one looks at the debit side of the cash book and the deposits column of the pass book and checks item by item one will find that the following cheques deposited with the bank. 200 is not done. 2XX1 1000 Dishonoured Cheque 1000 Adjusted cash book on 322XX1. This Cashbook can be adjusted to suit your financial year-end and is suitable for charities clubs sole tradersproprietors or small businesses. The single column cash book also known as simple cash book is a cash book that is used to record only cash transactions of a business. Preparing A Bank Reconciliation Statement Method Format Steps And Rules Solved Example.

Both sides consist of 3 columns each. These statements are key to creating financial models and accounting for. Cash Book and Bank Statement. Interest paid bank statement 46 080613-25. Single Column Cash Book. Bank Reconciliation Statement Example Accounting Corner.

Triple Column Cash Book. It is very identical to a traditional cash account in which all cash receipts are recorded on left hand debit side and all cash payments are recorded on right hand credit side in a chronological order. Interest received on bank statement 45 070613. Preparing Bank Reconciliation Statement. After these corrections we get our adjusted cash book and now we can begin with the reconciliation proper. Cbse Accountancy.

The cash book shows a balance of Rs 33000 whereas the pass book shows a balance of Rs 39930. The Blueprint explains what they are and why theyre so important. Bank Lodgement not shown on Bank Statement Cheques deposited on 311. Triple Column Cash Book. 2XX1 1000 Dishonoured Cheque 1000 Adjusted cash book on 322XX1. Preparing A Bank Reconciliation Statement Method Format Steps And Rules Solved Example.

For your financial statements to be accurate you must prepare and post adjusting entries. In the end the total of the amount column for both. Adjusted cash book format pdf A bank reconciliation statement is a document that compares the cash balance on the companys balance sheet to one of the three basic financial statements. In most businesses two or three column cash books with a bank column are used to record any transactions made through the bank account. For your financial statements to be accurate you must prepare and post adjusting entries. Preparation Of Bank Reconciliation Statement.

Cash Book Template With Discount. The receipts are recorded in the Dr Side and the payments are recorded in the Cr side of the cash book. These statements are key to creating financial models and accounting for. The single column cash book also known as simple cash book is a cash book that is used to record only cash transactions of a business. In this Cash Book three amount columns are maintained on both the debit and credit sidesthe first column is for discount the second for cash and the third for bank. Bank Reconciliation Statements.

This format of Cash Book is useful when either there is no bank transaction or bank transactions do not occur frequently. Credit memos Total Less. This Cashbook can be adjusted to suit your financial year-end and is suitable for charities clubs sole tradersproprietors or small businesses. It will be seen that whereas the pass book shows a credit balance of 243000 the cash-book shows a debit balance of 237000. Adjusted cash book format pdf A bank reconciliation statement is a document that compares the cash balance on the companys balance sheet to one of the three basic financial statements. Preparing A Bank Reconciliation Statement Method Format Steps And Rules Solved Example.

Interest paid bank statement 46 080613-25. Adjusted cash book format pdf A bank reconciliation statement is a document that compares the cash balance on the companys balance sheet to one of the three basic financial statements. Bank Charges 50 Handling fee for dishonoured cheque. TYPES OF CASH BOOK Cash book can be of four types. The single column cash book also known as simple cash book is a cash book that is used to record only cash transactions of a business. Bank Reconciliation Updating The Cash Book Youtube.

In most businesses two or three column cash books with a bank column are used to record any transactions made through the bank account. It has- 7 Income Accounts 20 Expense Accounts A Bank Reconciliation worksheet A Profit and Loss Report also called Income Summary or Income Statement. The receipts are recorded in the Dr Side and the payments are recorded in the Cr side of the cash book. Bank charges statement 48 090613-75. Format for bank reconciliation statement Before I share the format of a bank reconciliation statement please note that if on preparing your adjusted cash book the balance on the adjusted cash book agrees with the balance as per the bank statement then there is no need to. Bank Reconciliation Statement Definition Bank Reconciliation Statement Is.