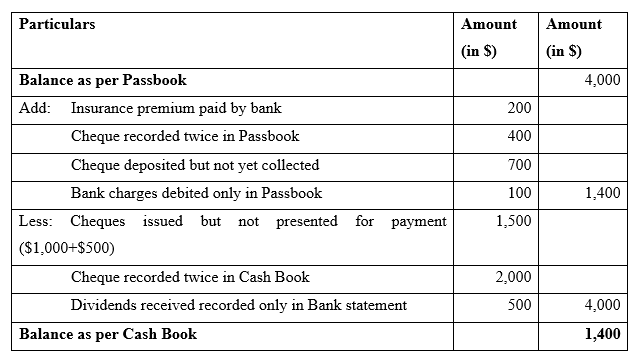

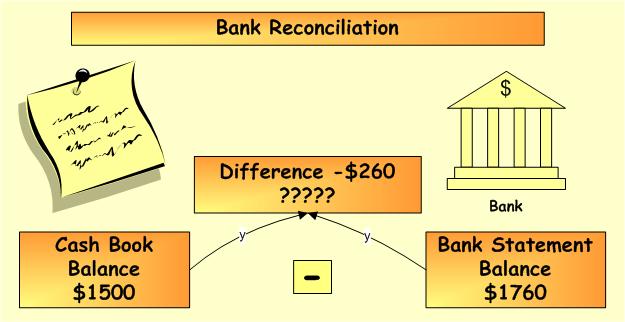

The goal of this process is to ascertain the differences between the two and to. Cheques issued but not presented for payment to bank 40000. bank reconciliation book side.

Bank Reconciliation Book Side, Bank Reconciliations only pull transactions back 13 months from the Statement Date. Download the Free Template. From the following particulars prepare a Bank Reconciliation Statement on 31 st October XXXX.

Bank Reconciliation Statement Brs Format And Steps To Prepare From toppr.com

Bank Reconciliation Statement Brs Format And Steps To Prepare From toppr.com

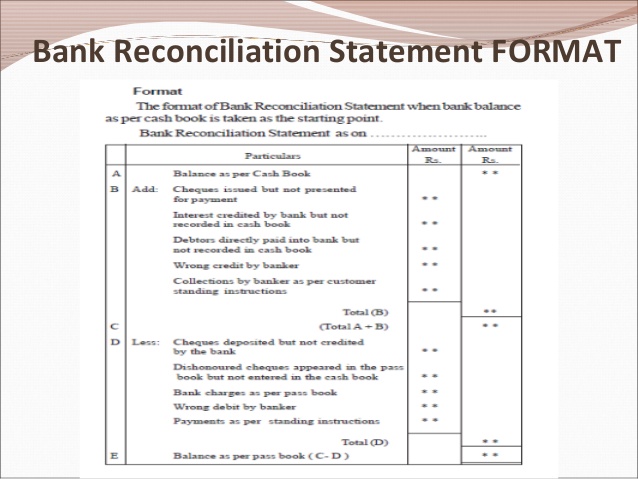

Highlight all transactions that you wish to change. To move book transactions to the bank side follow these steps. Bank Reconciliation Statement is a statement prepared periodically with a view to enlist the reasons for difference between the balances as per the bank column of the cashbook and pass bookbank statement on any given date.

From Cash Book and Pass Book.

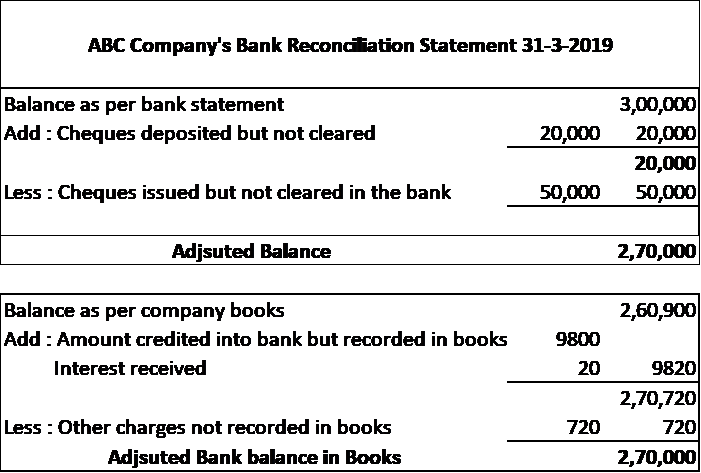

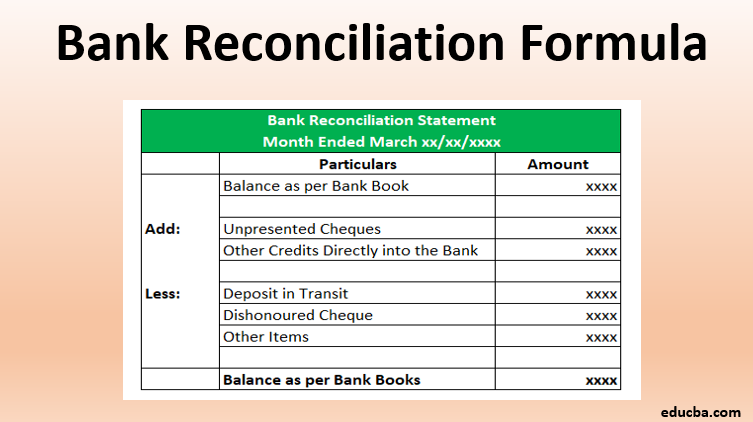

In this instance the bank will. Bank Reconciliation Formula Example 1. Preparing Bank Reconciliation Statement. The items on the bank reconciliation that require a journal entry are the items noted as adjustments to books. The bank sends the account statement to its customers every month or at regular intervals. Balance as per Bank Book is 8000.

Another Article :

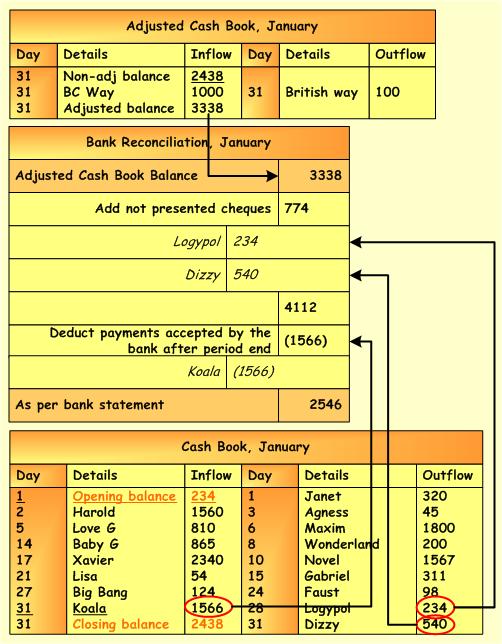

Bank Reconciliation Statement. This topic can be found in chap. After recording the journal entries for the companys book adjustments a bank reconciliation statement should be produced to reflect all the changes to cash balances for each month. Prepare bank reconciliation statement. When the reconciliation is completed both balances should match. Bank Reconciliation Instructions Reconciliation Account Reconciliation Bookkeeping And Accounting.

Preparing Bank Reconciliation Statement. There are two parts to a bank reconciliation the book company side and the bank side. It will also walk through a practice problem. Watch a Demo of BlackLine Account Reconciliations. So it is convenient to have separate books for each such class of transaction one for receipts and payments of. Bank Reconciliation Services Simple Accounting.

Prepare bank reconciliation statement. In the bank books the deposits are recorded on the credit side while the withdrawals are recorded on the debit side. Whenever we deposit or withdraws money from banks it is always recorded at two places-1. Cheques issued of Rs. Bank Reconciliation Formula Example 1. Sample Of A Company S Bank Reconciliation With Amounts Accountingcoach.

Upon completion of this chapter you will be able to. Ad Automate Standardise the Reconciliation Process to Produce Accurate Financial Statements. This statement is used by auditors to perform the companys year-end auditing. Examples of Cash Book. Watch a Demo of BlackLine Account Reconciliations. Sample Of A Company S Bank Reconciliation With Amounts Accountingcoach.

It will also walk through a practice problem. In this instance the bank will. From Cash Book and Pass Book. Cheques issued but not presented for payment to bank 40000. This Cash Book is maintained and entered by the trader himself. Bank Reconciliation Statement Example Accounting Corner.

This topic can be found in chap. Ad Automate Standardise the Reconciliation Process to Produce Accurate Financial Statements. Highlight all transactions that you wish to change. 20000 and 25000 but presented on 5th January 2019. Pass Book of Ms Jane shows an overdraft of 50000. Bank Reconciliation Accounting Play Accounting Education Accounting Basics Accounting Books.

Bank Reconciliation Statement. Describe the purpose of bank reconciliations. Interest on overdraft charged by the bank was 1500. This video is an example of how to reconcile the Cash T-Account book side during the bank reconciliation process. After recording the journal entries for the companys book adjustments a bank reconciliation statement should be produced to reflect all the changes to cash balances for each month. What Is Bank Reconciliation Accounting Corner.

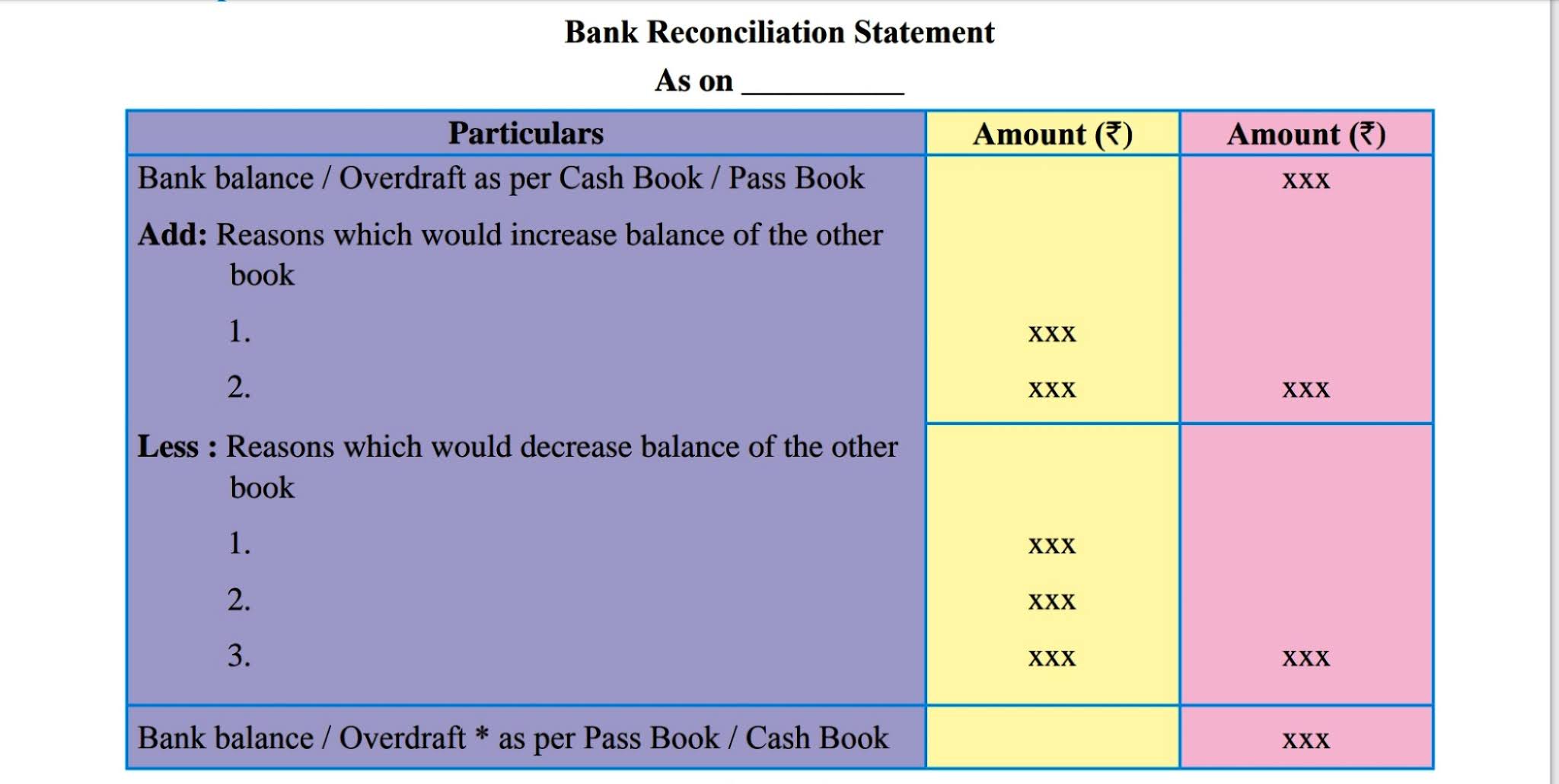

Pass Book of Ms Jane shows an overdraft of 50000. The bank reconciliation statement helps only to reconcile the balance. From the following particulars prepare Bank Reconciliation statement for Ms XYZ and company as at 31st December 2018. The left side is labeled Balance per BANK The right side is labeled Balance per BOOKS Adjustments to BANK shown on the left side are likely the items that are in the companys general ledger Cash account but they are not yet recorded in. Describe the purpose of bank reconciliations. What Is Bank Reconciliation Brs How To Prepare It.

This topic can be found in chap. The cash book shows a balance of Rs 33000 whereas the pass book shows a balance of Rs 39930. Notice the following items in the condensed bank reconciliation format. In the bank books the deposits are recorded on the credit side while the withdrawals are recorded on the debit side. There are a number of items that can cause differences between your book and bank balances. Bank Reconciliation.

The items on the bank reconciliation that require a journal entry are the items noted as adjustments to books. Pass Book of Ms Jane shows an overdraft of 50000. There are two parts to a bank reconciliation the book company side and the bank side. For a full and complete Bank Reconciliation both sides must balance. The bank sends the account statement to its customers every month or at regular intervals. How To Do Bank Reconciliation Accounting Corner.

Pass Book of Ms Jane shows an overdraft of 50000. It may happen that neither cash book balance nor pass book balance is correct because some receipts payments though recorded in cash book may be missing from pass book and similarly some receipts payments though recorded in the pass book may be missing from cash book. After recording the journal entries for the companys book adjustments a bank reconciliation statement should be produced to reflect all the changes to cash balances for each month. Bank Reconciliations only pull transactions back 13 months from the Statement Date. This topic can be found in chap. The Accounting Onion Bank Reconciliation Statement.

Notice the following items in the condensed bank reconciliation format. Notice the following items in the condensed bank reconciliation format. Bank column of the cash book. This Cash Book is maintained and entered by the trader himself. Bank Reconciliation Statement is a statement prepared periodically with a view to enlist the reasons for difference between the balances as per the bank column of the cashbook and pass bookbank statement on any given date. Bank Reconciliation Statement Meaning Need Format Preparation And Its Procedure Accounts And Quotes.

Need of preparing Bank Reconciliation Statement A Bank Reconciliation Statement is a statement reconciling the balance as. Watch a Demo of BlackLine Account Reconciliations. The bank sends the account statement to its customers every month or at regular intervals. Cheques issued but not presented for payment to bank 40000. You can do this by holding down the control CTRL key and left. Bank Reconciliation Statement Brs Format And Steps To Prepare.

Watch a Demo of BlackLine Account Reconciliations. If one looks at the debit side of the cash book and the deposits column of the pass book and checks item by item one will find that the following cheques deposited with the bank were not credited by the bank till 31st January. There are a number of items that can cause differences between your book and bank balances. Bank column of the cash book. The items on the bank reconciliation that require a journal entry are the items noted as adjustments to books. How Bank Reconciliation Statement Is Prepared Reconciliation Learn Accounting Accounting Principles.

The goal of this process is to ascertain the differences between the two and to. After recording the journal entries for the companys book adjustments a bank reconciliation statement should be produced to reflect all the changes to cash balances for each month. Cheques issued of Rs. Need of preparing Bank Reconciliation Statement A Bank Reconciliation Statement is a statement reconciling the balance as. It may happen that neither cash book balance nor pass book balance is correct because some receipts payments though recorded in cash book may be missing from pass book and similarly some receipts payments though recorded in the pass book may be missing from cash book. Bank Reconciliation Formula Examples With Excel Template.